The Cost

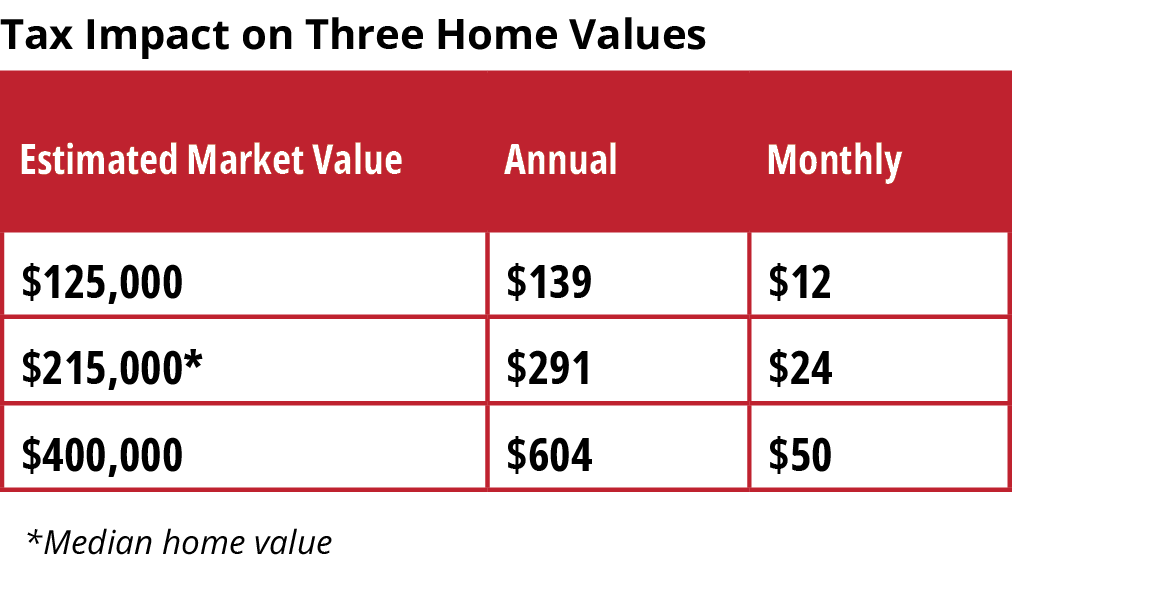

$24/month on $215,000 home

Breaks for Ag Land

$32.6 million total project cost

Calculate Your Personal Tax Impact

Click on the box below to visit the tax calculator and determine the specific tax impact for your home and agricultural property.

The project’s total cost is an estimated $32.6 million. Voter approval would grant the Osakis Schools District that sum in bonding authority to finance improvements to the existing school.

If the referendum is approved, an owner of the median $215,000 home would pay $24 per month in property taxes. The chart shows the tax impact for home and agricultural homesteads at a range of market value points.

70% Tax Credit for Agriculture Landowners

Interested in More Tax Relief?

The MN Department of Revenue says many property owners qualify and don’t do the paperwork to claim the refund.

Homestead Credit Refund

Available for all homestead property*, both residential & agricultural - house, garage & one acre (HGA only)

Refund is sliding scale, based on total property taxes & income (maximum refund is $3,310 for homeowners & $2,640 for renters)

Special Property Tax Refund

Available for all homestead property*, both residential & agricultural (HGA only) with a gross tax increase of at least 12% & $100 over prior year

Refund is 60% of tax increase that exceeds greater of 12% or $100 (max $1,000)

Senior Citizen Property Tax Deferral

Allows people 65 years of age or older with household income of $96,000 or less to defer a portion of property taxes on their home

Deferred property taxes plus accrued interest must be paid when home is sold or homeowner(s) dies